Page 6 - Credo Capital Finance - Finance Made Simple Digital Flipbook

P. 6

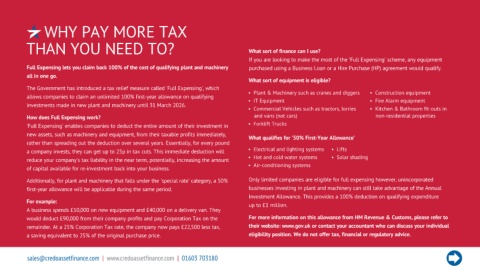

WHY PAY MORE TAX

THAN YOU NEED TO? What sort of finance can I use?

If you are looking to make the most of the 'Full Expensing' scheme, any equipment

Full Expensing lets you claim back 100% of the cost of qualifying plant and machinery purchased using a Business Loan or a Hire Purchase (HP) agreement would qualify.

all in one go.

What sort of equipment is eligible?

The Government has introduced a tax relief measure called 'Full Expensing', which

• Plant & Machinery such as cranes and diggers • Construction equipment

allows companies to claim an unlimited 100% first-year allowance on qualifying

• IT Equipment • Fire Alarm equipment

investments made in new plant and machinery until 31 March 2026.

• Commercial Vehicles such as tractors, lorries • Kitchen & Bathroom fit-outs in

How does Full Expensing work? and vans (not cars) non-residential properties

• Forklift Trucks

'Full Expensing' enables companies to deduct the entire amount of their investment in

new assets, such as machinery and equipment, from their taxable profits immediately,

What qualifies for '50% First-Year Allowance’

rather than spreading out the deduction over several years. Essentially, for every pound

• Electrical and lighting systems • Lifts

a company invests, they can get up to 25p in tax cuts. This immediate deduction will

• Hot and cold water systems • Solar shading

reduce your company's tax liability in the near term, potentially, increasing the amount

• Air-conditioning systems

of capital available for re-investment back into your business.

Additionally, for plant and machinery that falls under the 'special rate' category, a 50% Only limited companies are eligible for full expensing however, unincorporated

first-year allowance will be applicable during the same period. businesses investing in plant and machinery can still take advantage of the Annual

Investment Allowance. This provides a 100% deduction on qualifying expenditure

For example:

up to £1 million.

A business spends £50,000 on new equipment and £40,000 on a delivery van. They

would deduct £90,000 from their company profits and pay Corporation Tax on the For more information on this allowance from HM Revenue & Customs, please refer to

remainder. At a 25% Corporation Tax rate, the company now pays £22,500 less tax, their website: www.gov.uk or contact your accountant who can discuss your individual

a saving equivalent to 25% of the original purchase price. eligibility position. We do not offer tax, financial or regulatory advice.

sales@credoassetfinance.com | www.credoassetfinance.com | 01603 703180