Page 11 - Welcome to Kennet Equipment Leasing - Power to Grow

P. 11

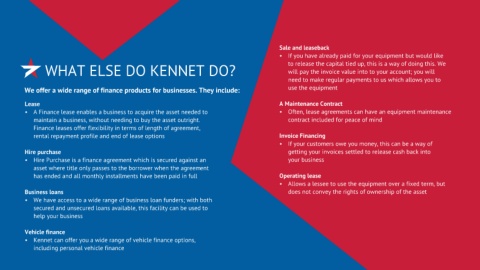

Sale and leaseback

• If you have already paid for your equipment but would like

to release the capital tied up, this is a way of doing this. We

will pay the invoice value into to your account; you will

need to make regular payments to us which allows you to

use the equipment

Lease A Maintenance Contract

• A Finance lease enables a business to acquire the asset needed to • Often, lease agreements can have an equipment maintenance

maintain a business, without needing to buy the asset outright. contract included for peace of mind

Finance leases offer flexibility in terms of length of agreement,

rental repayment profile and end of lease options Invoice Financing

• If your customers owe you money, this can be a way of

Hire purchase getting your invoices settled to release cash back into

• Hire Purchase is a finance agreement which is secured against an your business

asset where title only passes to the borrower when the agreement

has ended and all monthly installments have been paid in full Operating lease

• Allows a lessee to use the equipment over a fixed term, but

Business loans does not convey the rights of ownership of the asset

• We have access to a wide range of business loan funders; with both

secured and unsecured loans available, this facility can be used to

help your business

Vehicle finance

• Kennet can offer you a wide range of vehicle finance options,

including personal vehicle finance