Page 6 - Star Asset Finance - Finance Made Simple Digital Flipbook

P. 6

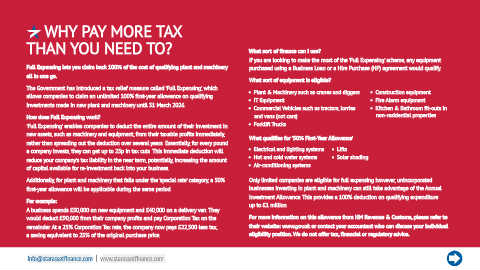

WHY PAY MORE TAX

THAN YOU NEED TO? What sort of finance can I use?

If you are looking to make the most of the 'Full Expensing' scheme, any equipment

Full Expensing lets you claim back 100% of the cost of qualifying plant and machinery purchased using a Business Loan or a Hire Purchase (HP) agreement would qualify.

all in one go.

What sort of equipment is eligible?

The Government has introduced a tax relief measure called 'Full Expensing', which

allows companies to claim an unlimited 100% first-year allowance on qualifying • Plant & Machinery such as cranes and diggers • Construction equipment

• Fire Alarm equipment

• IT Equipment

investments made in new plant and machinery until 31 March 2026.

• Commercial Vehicles such as tractors, lorries • Kitchen & Bathroom fit-outs in

How does Full Expensing work? and vans (not cars) non-residential properties

'Full Expensing' enables companies to deduct the entire amount of their investment in • Forklift Trucks

new assets, such as machinery and equipment, from their taxable profits immediately, What qualifies for '50% First-Year Allowance’

rather than spreading out the deduction over several years. Essentially, for every pound

a company invests, they can get up to 25p in tax cuts. This immediate deduction will • Electrical and lighting systems • Lifts

reduce your company's tax liability in the near term, potentially, increasing the amount • Hot and cold water systems • Solar shading

of capital available for re-investment back into your business. • Air-conditioning systems

Additionally, for plant and machinery that falls under the 'special rate' category, a 50% Only limited companies are eligible for full expensing however, unincorporated

first-year allowance will be applicable during the same period. businesses investing in plant and machinery can still take advantage of the Annual

Investment Allowance. This provides a 100% deduction on qualifying expenditure

For example: up to £1 million.

A business spends £50,000 on new equipment and £40,000 on a delivery van. They

would deduct £90,000 from their company profits and pay Corporation Tax on the For more information on this allowance from HM Revenue & Customs, please refer to

remainder. At a 25% Corporation Tax rate, the company now pays £22,500 less tax, their website: www.gov.uk or contact your accountant who can discuss your individual

a saving equivalent to 25% of the original purchase price. eligibility position. We do not offer tax, financial or regulatory advice.

info@starassetfinance.com www.starassetfinance.com